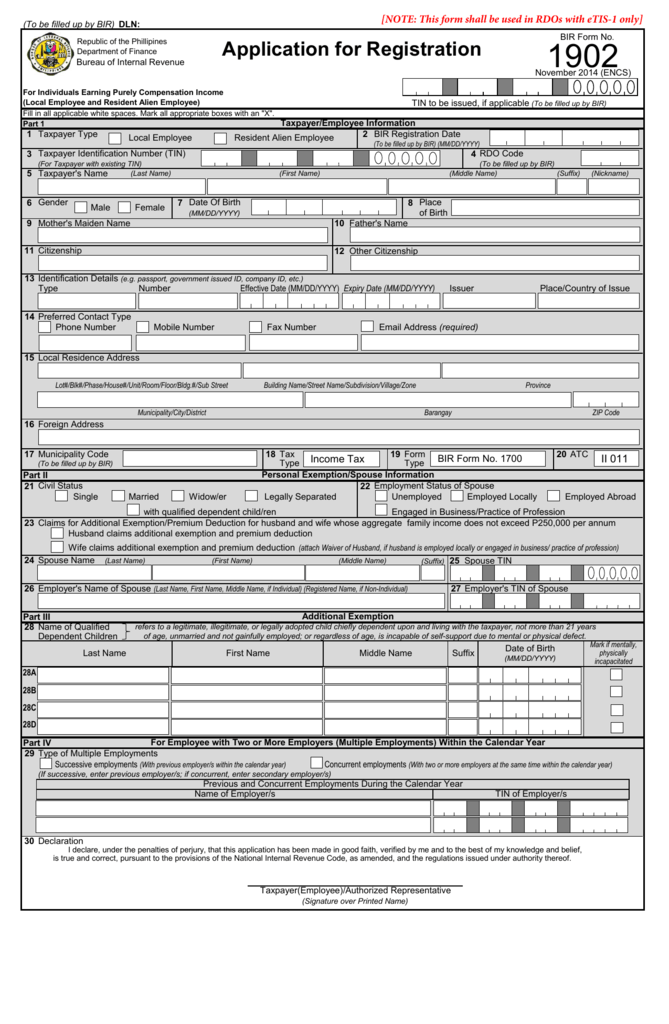

Tin Number With 1902 Form . if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. tin application using bir form 1902 (for local and alien employees earning purely compensation income). how to get tin number for employees.

from studylib.net

Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. how to get tin number for employees. Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. tin application using bir form 1902 (for local and alien employees earning purely compensation income).

BIR Form 1902 eTIS

Tin Number With 1902 Form how to get tin number for employees. Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. tin application using bir form 1902 (for local and alien employees earning purely compensation income). how to get tin number for employees. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of.

From campolden.org

How To Search Tin Number By Company Name Templates Sample Printables Tin Number With 1902 Form how to get tin number for employees. tin application using bir form 1902 (for local and alien employees earning purely compensation income). Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. Fill out bir form 1902 and submit it along with the other requirements for the tin number. Tin Number With 1902 Form.

From www.vrogue.co

1902 Form What Is It How To Get And Fill Up 2020 Kami vrogue.co Tin Number With 1902 Form Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. tin application using bir form 1902 (for local and alien employees earning purely compensation income). Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. how to get tin number. Tin Number With 1902 Form.

From www.signnow.com

1902 Bir Form Complete with ease airSlate SignNow Tin Number With 1902 Form how to get tin number for employees. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. tin application using bir form 1902 (for local and alien employees earning purely compensation. Tin Number With 1902 Form.

From www.philippinetaxationguro.com

How to Get TIN ID Online 2021 Fast and Easy Way Tin Number With 1902 Form tin application using bir form 1902 (for local and alien employees earning purely compensation income). how to get tin number for employees. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to. Tin Number With 1902 Form.

From tinidentificationnumber.com

Online TIN Number Application TIN Number Tin Number With 1902 Form how to get tin number for employees. Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. if you don’t file a bir form 1902, you will not be able. Tin Number With 1902 Form.

From twomonkeystravelgroup.com

How to get a BIR TIN and TIN ID in the Philippines Tin Number With 1902 Form tin application using bir form 1902 (for local and alien employees earning purely compensation income). Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. if you don’t file a bir form 1902, you will not be able to get a. Tin Number With 1902 Form.

From www.youtube.com

PAANO KUMUHA NG 1902 FORM SA BIR TIN NUMBER YouTube Tin Number With 1902 Form Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. tin application using bir form 1902 (for local and alien employees earning purely compensation income). if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Without a tin, you. Tin Number With 1902 Form.

From www.philippinetaxationguro.com

BIR Form 1904 A Comprehesive Guide TAXGURO Tin Number With 1902 Form tin application using bir form 1902 (for local and alien employees earning purely compensation income). Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). possession of more. Tin Number With 1902 Form.

From www.formsbank.com

Fillable Taxpayer Identification Number (Tin) Verification printable pdf download Tin Number With 1902 Form possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such. Tin Number With 1902 Form.

From philippinwoodpro.blogspot.com

1902 bir form philippin news collections Tin Number With 1902 Form if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such. Tin Number With 1902 Form.

From www.philippinetaxationguro.com

How to Get TIN number online and TIN ID Online Fast and Easy Way Tin Number With 1902 Form Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. if you don’t. Tin Number With 1902 Form.

From www.scribd.com

Bir Form 1902 Identity Document Government Tin Number With 1902 Form Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. if you don’t file a bir form 1902, you will not be able to. Tin Number With 1902 Form.

From philippinwoodpro.blogspot.com

1902 form philippin news collections Tin Number With 1902 Form possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. . Tin Number With 1902 Form.

From www.youtube.com

ANO ANG BIR FORM 1902? YouTube Tin Number With 1902 Form possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. tin application using bir form 1902 (for local and alien employees earning purely compensation income). Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax. Tin Number With 1902 Form.

From campolden.org

How To Search My Bir Tin Number Templates Sample Printables Tin Number With 1902 Form possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of. how to get tin number for employees. if you don’t file a bir form 1902, you will not be able to get a taxpayer identification number (tin). Without a tin, you will not be able to process any transaction with. Tin Number With 1902 Form.

From bir-1902-form-application-for-registation.cocodoc.com

Tin ID Application Forms Fill & Download Online Registration (FREE) Tin Number With 1902 Form Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. how to get tin number for employees. Fill out bir form 1902 and submit it along with the other requirements for the tin number to your. possession of more than one taxpayer identification number (tin) is criminally punishable pursuant. Tin Number With 1902 Form.

From suppliergateway.zendesk.com

Entering Your US taxpayer Identification Number (TIN) SupplierGATEWAY Support Center Tin Number With 1902 Form tin application using bir form 1902 (for local and alien employees earning purely compensation income). Obtain a copy of bir form 1902 from the bureau of internal revenue (bir) website or from the revenue. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income. Tin Number With 1902 Form.

From philippinwoodpro.blogspot.com

1902 bir form philippin news collections Tin Number With 1902 Form possession of more than one taxpayer identification number (tin) is criminally punishable pursuant to the provisions of the. Without a tin, you will not be able to process any transaction with the bureau of internal revenue (bir), such as filing your annual income tax return. if you don’t file a bir form 1902, you will not be able. Tin Number With 1902 Form.